6 Easy Facts About Your Home And Garden Described

Some loan providers need you to pay your home tax obligations as well as your home owners insurance coverage as component of your mortgage payment. Figure out all the cost elements that compose a regular mortgage payment, and also utilize our to estimate your regular monthly home mortgage settlement. You normally have to pay sales tax obligation when you acquire something in a shop.

On most trips, you will not need to depend on it, however the once you diminish your bike, it might save your life. Even if you assume you don't need home insurance, lots of mortgage lenders require you to have it. There are two primary kinds of homeowners insurance coverage: house and also personal home insurance policy.

The price fluctuates based on your degree of insurance coverage and also area. On standard, homeowner's insurance costs around $1,428 per year for a policy with $250,000 in residence protection. When making a decision on exactly how much coverage to acquire, think about just how much it would certainly cost to rebuild your residence instead of taking a look at how much your residence is worth.

Some Known Questions About Your Home And Garden.

You can likewise consider some prominent affordable upgrades to potentially enhance your home's worth (which could bring about a greater sale price ought to you make a decision to move). Maintenance costs differ commonly, whether you a home. Utilities might not be leading of mind when it pertains to homeownership costs, however whether it's your electricity, water, a/c, warmth or Wi, Fi they are difficult to live without as well as rates can vary based on your place as well as dimension of your residence (even the age of you're A/C can influence your costs).

The last thing you want to fret around as a property owner is insects invading your home. You may need to buy professional insect control to maintain animals out of your area. You can anticipate to pay between $400 as well as $950 yearly for basic, full-service parasite control, but the expense can differ depending on your circumstances.

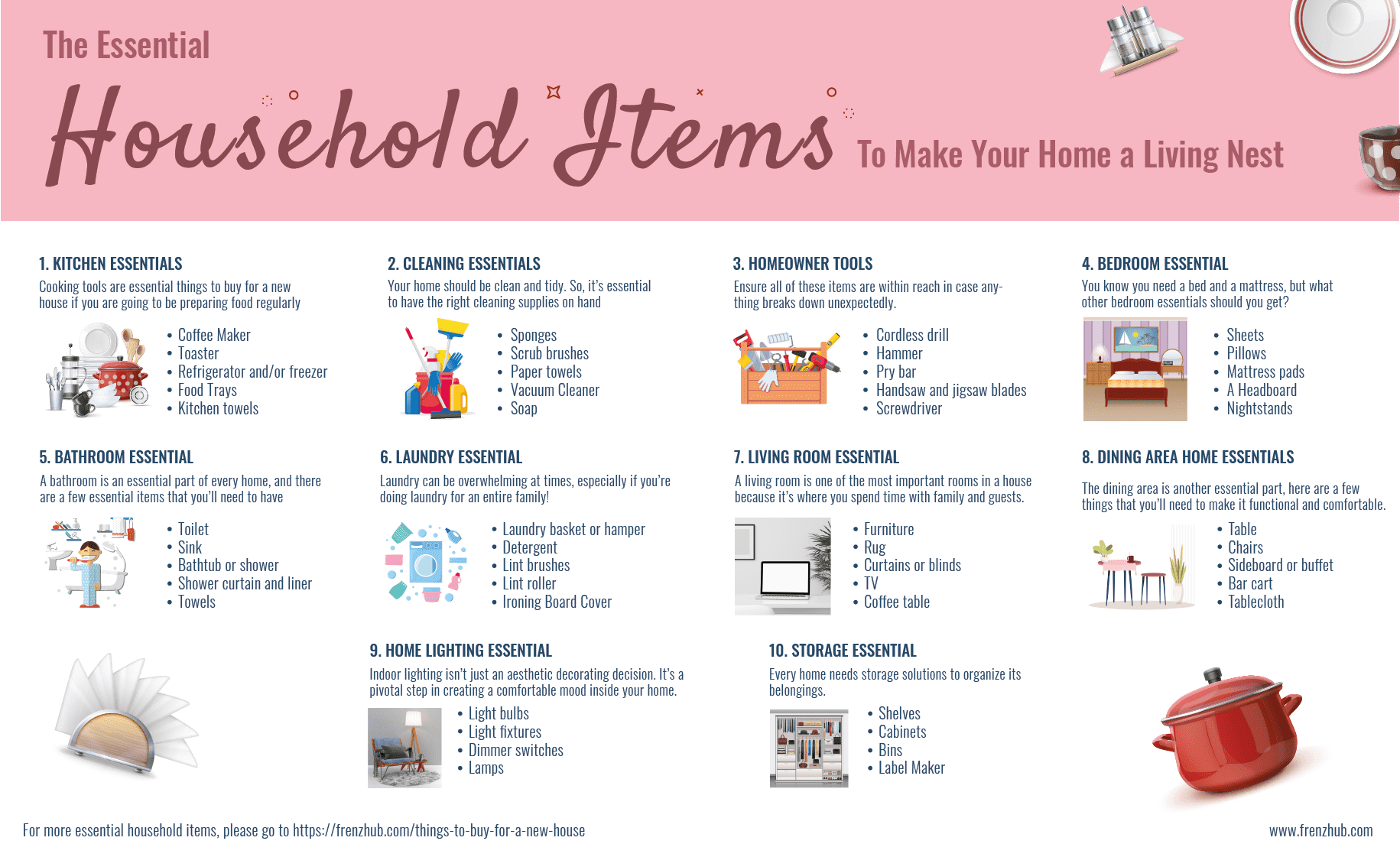

Your house might have major home appliances, such as a cooktop, oven, refrigerator as well as dishwasher. But if your house does not have any type of home appliances you can not live without, you'll require to begin saving for them. New appliances can differ extensively depending on the type, design and rate (varying in ordinary in between $350 and also $8,000), so be certain to make up any type of missing appliances while you house hunt.

Excitement About Your Home And Garden

Consider investing a long time living in the area to find out your exact demands in terms of storage space, organization and style. Take stock of items you already have that you plan to bring right into your new residence and also begin saving for those in the future. If you wish to furnish your whole house, the ordinary expense is $16,000.

https://www.provenexpert.com/your-home-and-garden/?mode=preview

You'll be extra ready to take the jump once you pass the number crunching (and also expecting the unexpected). Try using an expense of homeownership calculator to aid you compute the real costs. Note that you'll experience different rates if you mean to.

Advertisements by Cash. We may be made up if you click this advertisement. Ad The housing market has been kind to property owners these last couple of years. The ordinary residence worth has actually leapt 43% given that late 2019, and sellers have generated eye-popping earnings due to it. That was then. As we head in 2023, the marketplace looks really various.

Your Home And Garden Can Be Fun For Everyone

Residence sales have actually slowed down 6% compared to last year, and also costs have already begun to fall (at the very least monthly). "Most projections are now calling for a decrease in house costs following year," claims Kenon Chen, executive vice head of state of corporate approach at Clear Resources, a genuine estate data and technology service provider.

Which group do you fall right into? Below's what reduced home values would actually indicate for property owners as well as that must (as well as should not) be fretted.

"If you acquired your home in 2008 or 2009, offering in 2023 will still be successful for you," states Maureen Mc, Dermut, a realty representative with Sotheby's International Real estate in Santa Barbara, California. "If you got in 2021 and also want to offer in 2023, then you may wind up taking a loss.

Your Home And Garden for Beginners

Advertisement Decreasing house worths would additionally mean less equity for house owners across the board. House equity or the difference between your home's existing value and any kind of mortgage finances tied to it has actually increased in current years.

The even more equity you have, the a lot more you stand to acquire when you market. Much more than this, equity is additionally a financial tool. You can obtain against it utilizing a cash-out re-finance, home equity finance visit this site right here or home equity credit line (HELOC) as well as transform it into money without selling.

If equity declines, though, house owners will certainly have the ability to obtain much less or perhaps not be qualified for these types of products at all. This can be huge thinking about exactly how popular HELOCs have actually come to be in current months. In the first fifty percent of 2022, HELOC lending reached its highest point in 15 years, leaping 30% compared to 2021.

Unknown Facts About Your Home And Garden

"If a homeowner believes they may need to touch right into some of that equity, it's much better to obtain that HELOC in position currently." Those that currently have HELOCs might see their credit lines reduced or frozen significance they will not be able to take out additional funds. Lenders do this to avoid borrowers from overleveraging.

https://www.twitch.tv/urh0megarden/about

If this were to take place as well as you required to market, the property would not make enough to pay off your full finance equilibrium. You 'd then either encounter a short sale when you offer your house at a steep discount rate as well as settle what you can (with your loan provider's approval initially) or a foreclosure, in which the bank takes your residence as well as markets it off for you.